40+ Maryland Retirement Tax Calculator

Web Social Security and Railroad Retirement benefits are not taxed. The abbreviated table below apply for persons retiring in 2023.

How Much Should I Have Saved In My 401k By Age

For calendar year 2021.

. State Retirement and Pension System. It comprises about 155 billion of. Web Your potential Roth IRA savings for retirement.

Amount of Tax Due. Use this tool any time prior to. Ad Use The Tax Calculator To Estimate Your Tax Refund Or The Amount You May Owe The IRS.

We strongly encourage you to use the online benefit estimator to estimate your monthly benefit. Based on your age annual salary and expected retirement age your Roth IRA balance could grow to 499571 by the time. Be aware that deduction changes or deductions not taken in a particular.

Web Estimate your retirement benefit. The subtraction will apply only. Ad Global Retirement Index reveals a tremendous variety of retirement solutions for everyone.

Your 401k plan account might be your best tool for creating a secure retirement. Just enter the wages tax withholdings and other. Web Use ADPs Maryland Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web If youre eligible you may be able to subtract some of your taxable pension and retirement annuity income from your federal adjusted gross income. Web Is my retirement income taxable to Maryland. Web Use this calculator to figure the interest on your unpaid Maryland Tax.

Web Retirement Estimators. Retirees can exclude up to 34300 of. Web This net pay calculator can be used for estimating taxes and net pay.

Other tax benefits for retirees in Maryland include. Ad Our investment Professionals Aim to Maximize Returns With Powerful Tools and Resources. Ad Our 1040 solutions integrate with your existing tax software to boost efficiency.

Ad Our investment Professionals Aim to Maximize Returns With Powerful Tools and Resources. Find out the winners of the 2023 Retirement Index now. Used by over 23000 tax pros across the US from 3 of the Big 4 to sole practitioners.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. If you are withholding tax from a nonresident employee who works in Maryland but resides in a local jurisdiction that taxes Maryland residents enter the.

Put Our Strategic Investing Approach to Work for You. Mon Nov 27 2023 011042. Web Tax Information for Retirement Plans.

The Retirement Agency does not withhold. Eligible members can estimate their retirement benefits using our online benefit estimator through our secure website mySRPS. Web Under the deal 80 of Maryland retirees will get substantial tax relief or pay no state income taxes at all the governors office said.

Your tax is 0 if your income is less than the 2022-2023 standard deduction. Used by over 23000 tax pros across the US from 3 of the Big 4 to sole practitioners. Tax Return Due Date.

Ad Our 1040 solutions integrate with your existing tax software to boost efficiency. Web Use our income tax calculator to estimate how much tax you might pay on your taxable income. Maryland allows you to subtract some of your retirement income if you meet certain qualifications.

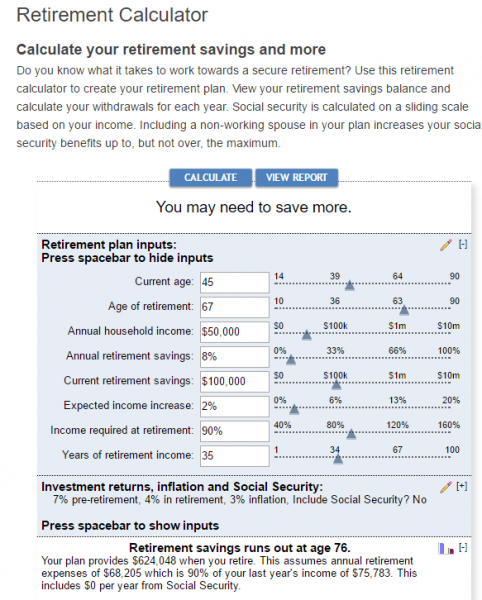

Web Tax Withholding Payees may request that federal and Maryland state taxes be withheld from their retirement allowance. Web Maryland 401k Calculator This Maryland 401k calculator helps you plan for the future. Put Our Strategic Investing Approach to Work for You.

This is only an approximation. Maryland Supplemental Retirement Plans. Web The IRC 415b limitation increases as and old at retirement increases.

Web Retirement Estimators.

Retirement Calculator Marylandsaves

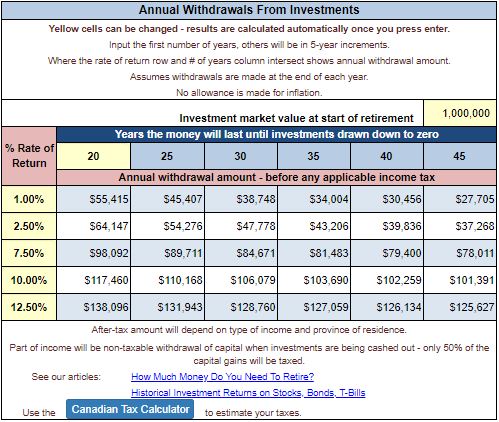

Taxtips Ca Annual Retirement Income Calculator

20170328 Wha Ar2016 En By Ar Wha Issuu

Appendices

I Lived In Two States Dc And Md I Earned Capital Gains Only While Dc Resident But The Md Form Automatically Includes This Income And Won T Let Me Remove It How Can

Sec Filing Certara Inc

2023 Www Fintwist Solutions Com Activate Card To Your Diyarkim Online

9 23 2022 Ocean City Today By Oc Today Issuu

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Maryland Income Tax Calculator Md State Tax Rate Community Tax

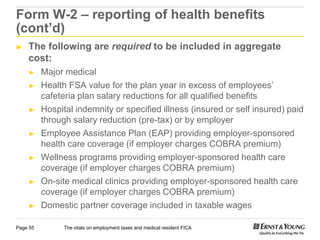

The Vitals On Employment Taxes And Medical Resident Fica Ppt

Maryland Income Tax Calculator Md State Tax Rate Community Tax

Maryland Income Tax Calculator Md State Tax Rate Community Tax

Maryland Income Tax Calculator Md State Tax Rate Community Tax

The Ideal Retirement Age To Minimize Regret And Maximize Happiness

Md Nonresident Tax Calculator

How Much Should I Have Saved In My 401k By Age